Looking for your business'

tax time side kick?

KA-POW!

Defeat lodgement and maximise your return.

|

Holy Tax Time Batman!

Much like the daily threats upon Gotham City, small businesses face a multitude of challenges day to day. Back on the streets, tax time has returned as the latest imposition on small businesses radar.

Like Robin to Batman, we’re ready to assist you in any way we can. Working alongside an RSM adviser you’ll gain understanding of tax laws that apply to your business, guidance on relevant documentation you need to provide and assistance in minimising your business tax liability.

Whether you need assistance from start to finish

or a second pair of eyes to review everything before lodging your return online, the challenges of tax time will be no match for this dynamic duo.

No need to send up the bat signal, book your appointment online today

Before you leave the Bat Cave...

When tackling the taxes of your business, ensure that your utility belt is armed with the right tools.

Download our FREE Tax Time Checklist for businesses to ensure you are ready for lodgement.

Why team up with RSM, the accounting wonder?

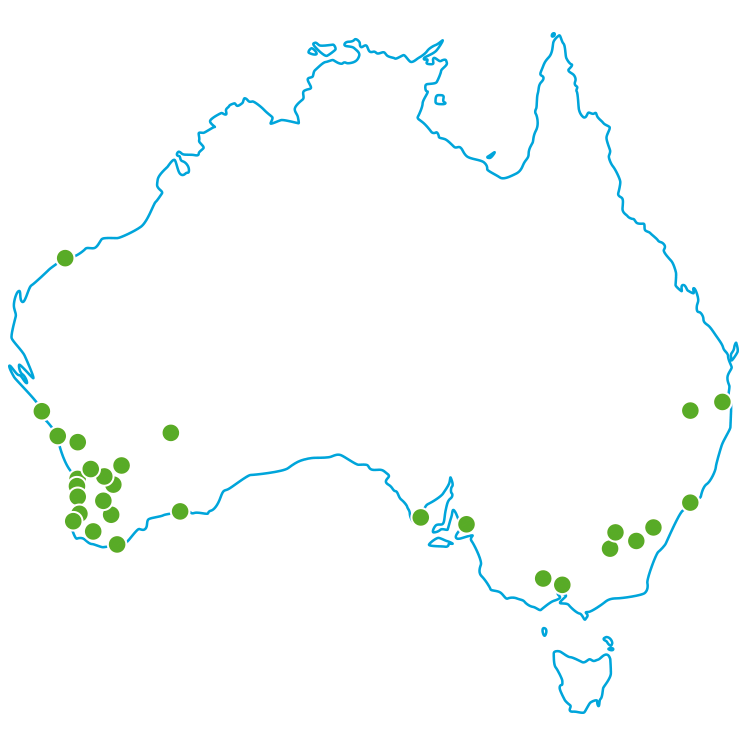

Over 95 years of experience assisting businesses with their tax and beyond.

A full package personalised and professional service with no hidden fees.

A locally based team who will work closely with you to maximise your return.

Not the hero you need right now

Tax time already under control? RSM deals with more than tax returns and can assist in managing taxation commitments and running a profitable business.

Speak to RSM for assistance with;

- Business planning

- Cloud accounting and digital services

- Succession and estate planning

- Business strategy and development

- Budgeting

- Business purchase and structuring guidance

- Growth and profit solutions diagnostics

More interested in ‘Bruce Wayne’ than ‘Wayne Enterprises’?

Liability limited by a scheme approved under Professional Standards Legislation.

RSM Australia Pty Ltd is a member of the RSM network and trades as RSM. RSM is the trading name used by the members of the RSM network.

Each member of the RSM network is an independent accounting and advisory firm each of which practices in its own right. The RSM network is not itself a separate legal entity of any description in any jurisdiction. The RSM network is administered by RSM International Limited, a company registered in England and Wales (company number 4040598) whose registered office is at 50 Cannon Street, London, EC4N 6JJ.

The brand and trademark RSM and other intellectual property rights used by members of the network are owned by RSM International Association, an association governed by article 60 et seq of the Civil Code of Switzerland whose seat is in Zug. Any articles or publications contained within this website are not intended to provide specific business or investment advice. No responsibility for any errors or omissions nor loss occasioned to any person or organisation acting or refraining from acting as a result of any material in this website can, however, be accepted by the author(s) or RSM International. You should take specific independent advice before making any business or investment decision.